Risk Management Using Monte Carlo Simulations

Monte Carlo simulations have become an increasingly popular method for pricing derivatives and managing risk in financial markets. This article will explore the concept of Monte Carlo simulations, their application to derivatives pricing and risk management, and the benefits of using this approach in financial markets.

Derivatives are financial instruments whose values are derived from the values of underlying assets. They are widely used in financial markets to hedge risks and generate returns. Pricing derivatives accurately and managing the associated risks are critical tasks for financial institutions. Monte Carlo simulations are an innovative approach to pricing derivatives and managing risks that involves generating numerous scenarios and evaluating the outcomes of each scenario. This approach has become increasingly popular in financial markets due to its flexibility and accuracy.

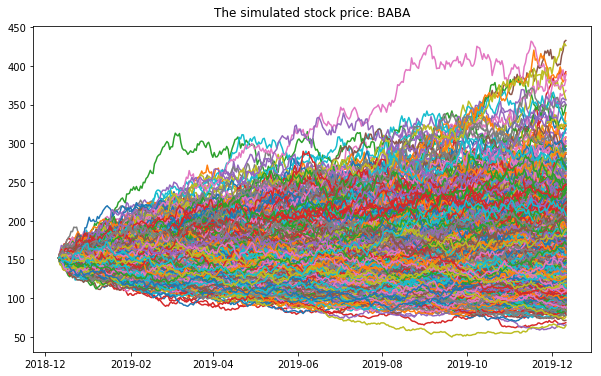

Monte Carlo simulations involve generating a large number of random scenarios and evaluating the outcomes of each scenario. In the context of derivatives pricing, Monte Carlo simulations can be used to estimate the value of a derivative by generating numerous scenarios of future asset prices and calculating the payoff of the derivative in each scenario. By averaging the payoffs across all scenarios, the expected value of the derivative can be estimated. This approach provides a more accurate estimate of the value of a derivative than traditional models that rely on simplifying assumptions.

In the context of risk management, Monte Carlo simulations can be used to estimate the potential losses that a portfolio may experience under different market conditions. This approach involves generating numerous scenarios of future asset prices and evaluating the impact of each scenario on the portfolio's value. By simulating a large number of scenarios, a more accurate estimate of potential losses can be obtained than by relying on historical data or simplistic models.

There are several benefits to using Monte Carlo simulations for derivatives pricing and risk management. Firstly, Monte Carlo simulations can accommodate complex models that traditional methods cannot handle. This flexibility allows for more accurate pricing of derivatives and better estimation of potential losses. Secondly, Monte Carlo simulations can handle non-normal distributions, which are common in financial markets. Traditional methods that assume normal distributions may provide inaccurate estimates in these cases. Lastly, Monte Carlo simulations can be used to evaluate the impact of different market scenarios on a portfolio, allowing investment managers to better manage risk.

What Does This Mean for the Future:

Monte Carlo simulations are a powerful tool for pricing derivatives and managing risk in financial markets. This approach involves generating numerous scenarios and evaluating the outcomes of each scenario, providing a more accurate estimate of the value of a derivative and potential losses in a portfolio. Monte Carlo simulations offer several benefits over traditional methods, including greater flexibility, the ability to handle non-normal distributions, and the ability to evaluate the impact of different market scenarios on a portfolio. As financial markets become increasingly complex, Monte Carlo simulations will continue to play a critical role in derivatives pricing and risk management.