The 5 Principal Kinds of DAOs

DAOs began to garner attention in 2016 by raising $150 million in history's most extensive crowdfunding campaign. Despite being a novelty, contemporarily, they already manage over $10B+ in assets. These autonomous organizations are most predominant in 5 categories.

What is a DAO:

A DAO is an acronym for "decentralized autonomous organization." Breaking this phrase down: decentralized denotes that they are delegated away from a central, authoritative group while autonomous alludes to the freedom to control their affairs. Additionally, these organizations have rules that community members must endure. A transparent program stores these conventions alongside financial records to maintain the members' commitments to the DAO. Accompanied by this technology, smart contracts are another prerequisite to the success of these corporations.

Protocol DAOs

Definition: This layout makes members of the group stakeholders in a governance system in which they equitably advance the underlying platform. However, Protocol DAOs can also be created to provide decentralized services to users through smart contracts.

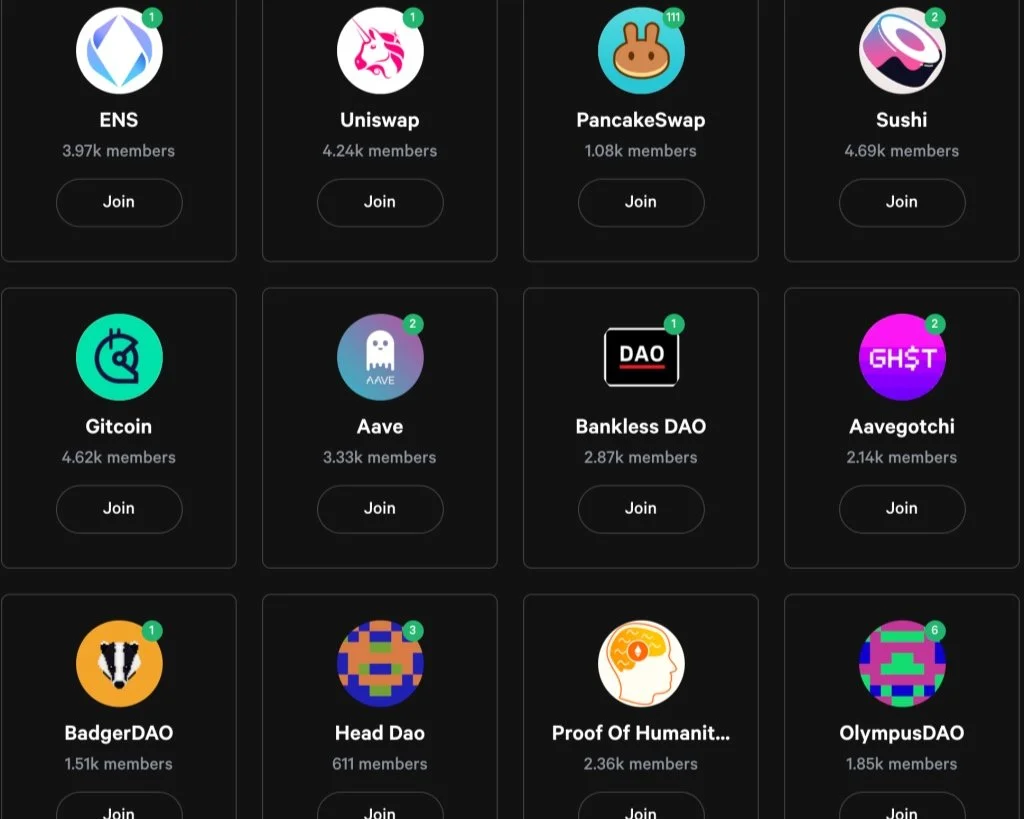

Example: Uniswap is currently the largest DAO, and it exists as a decentralized currency exchange on the Ethereum blockchain. They offer pairs of tokens to trade and convert. These tokens' prices are set through mathematical formulas, and Smart Contracts carry out the actual transactions. However, Uniswap also has a governance token known as UNI. By holding it, investors can participate in how the platform is run.

Social DAOs

Definition: A Social DAO is a community of like-minded individuals who meet anonymously due to a specific shared objective. Members determine this purpose by voting on the DAO. However, these clubs are exclusive, as users are only granted entry when they purchase some of the DAO tokens or NFT's.

Example: "Friends with Benefits" is the most popular social DAO, and users gain entry by owning numerous FWB tokens. The DAOs cryptocurrency rises parallel to the organization's success, incentivizing members to work together. The creation of this group is meant to unify artists and cultural thinkers through events, discussions, and even an auction platform for digital collectibles. All decisions in this DAO are made through a voting process.

Investment DAOs

Definition: Investment DAOs can be compared to traditional investment funds as both of them operate with pooled capital. This capital comes from the DAOs token, which members must hold, to be a part of the group. The constituents then vote on where to invest this money, eventually sharing their investment returns.

Example: The most innovative DAO in this category is MetaCartel Ventures. They invest in budding decentralized applications by pooling the organizations' money together. Their purpose is summed up by their slogan: "If you want to go fast, go alone. If you want to go far, go together". This group is so unorthodox because it opened up investing in start-ups to everyone instead of accredited investors, angel investors, and traditional venture capitalists.

Grant DAOs

Definition: A Grant DAO is a group created to fund new projects, with the organizations submitting their applications. Usually, they end up financing Decentralized Finance activities. Usually, their grants emerge with a charitable goal in mind. These corporations were one of the first formats of DAOs altogether.

Example: Gitcoin is the most prevalent DAOs in this format. This platform mainly funds programmers that define the future of the open web—aiming to create financial freedom, donors brose the listed projects and choose what to support. Like any other DAO, GTC is Gitcoins cryptocurrency used in the treasury alongside grants.

Collector DAOs

Definition: Collector DAOs have had a surge in development and popularity in recent years due to the proliferation of NFTs. These DAOs allow members to share the costs and value of an expensive asset.

Example: PleasrDAO has purchased many collectibles since its inception. They have bought real-life artwork, NFT's, music, and much more. The most famous purchase that brought them head-line fame is purchasing the "Once Upon A Time in Shaolin" album for $4 million. They also purchased the original Doge Meme NFT for another $4 million. The member's dedication to the arts allows them to share ownership of otherwise inaccessible collectibles.

What Does This Mean for the Future:

Decentralized autonomous organizations are paving the way for modern finance. DAOs from each category will eventually govern billions of dollars and be the upgrade path for future financial infrastructure. Billions of members will share the value of countless commodities.