The Advancements of Stock Trading

In the past century, stock trading has evolved because of new methods and technologies. FinTech is advancing the process as companies like Robinhood and SoFi take the investing world by storm, making investing more straightforward and user-friendly.

In the 1900s, stocks were traded exclusively in stock exchanges, primarily the New York Stock Exchange, with high fixed commissions. Today, stocks can be traded whenever, wherever, all with zero commissions. Over time, the methods of doing the same task - trading stock - have significantly differentiated. The question is, how does such development occur, and what does the future hold for stock trading?

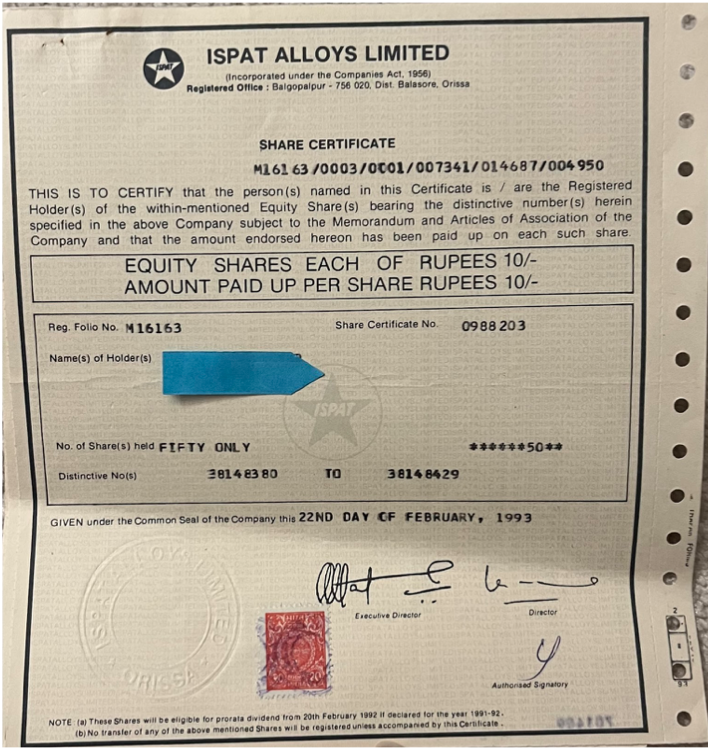

To assess the present and future, it is necessary to understand the past. In the original method of trading stocks, the buyer/seller must contact the broker, who then places the requested order. Next, the broker informs you when the stock is bought/sold. In a week, you will receive a tangible certificate of the stock in the mail if you bought it, and you will receive the money if you sold it. When purchasing, you must deposit a check, and when trading, you must mail the certificate back to the broker, who then dispatches it to the next buyer.

Above: An authentic stock certificate bought by my grandfather

Now, let's fast forward 50 years or so. Technology in the financial field is rapidly expanding, and companies like Robinhood and SoFi are the next stop in the stock trading advancement train.

Robinhood has surged in popularity in response to the COVID pandemic. 60% of the young investors started investing in 2020. The company completely changed the game for young investors, as its user-friendly interface and comprehensible language simplify the investigation process. Of course, the child accounts are supervised under a parent account so that the child can learn and invest responsibly. In addition, it contains zero-commission trading though it does take $0.000130 per share as a trading activity fee to obtain revenue. Through new technology which better fits the lives of Millennials and Gen Z, Robinhood can better connect with consumers.

SoFi Active Investing is very similar to Robinhood, except it focuses more on passive investing. For those unfamiliar with the term, passive investing is when an investor does not look at the market every day but instead of long-term investors. The opposite of this is active investing, which is when investors are constantly watching the movements of stocks and are more likely to be short-term investors. SoFi's mission is to help its customers reach financial stability and make investing accessible to everyone by using its technology to fit clients' needs.

What Does This Mean for the Future:

Stock trading has significantly advanced, leading to more and more people becoming aware and educated enough to invest themselves. In addition, technology has revolutionized the past methods, and as new technology companies are founded, everyone will have the ability to trade stock.