Climate FinTech’s Rise to Power

Combining two powerful industries could create power products, and perhaps that is exactly what Climate FinTech companies aim to achieve. Climate Tech’s role in the technology industry is impactful, with its advanced solutions to reduce carbon emissions, adapt to new climates, and more. One essential part of Climate Tech is fintech software, and its use of it has been rising since the start of 2022.

Augmented Reality: The Finance Sector’s New Medium

Augmented realities have seeped their way into our lives in various ways including entertainment mediums like gaming, facilitating online meetings in the business world, and offering training to the medical and military fields. This was especially useful when the Coronavirus pandemic hit our lives in 2020, halting nearly every aspect of our life. As we begin to segue into a new state of “normal”, we must begin to ask ourselves, “Can we use this technology in other parts of our lives?”.

Hardware Wallets: The Way To Interact With The Fintech Industry

In a time when the Fintech industry is growing at such a rapid rate, more and more people join every day. However, with the new investors come cyber attacks, hardware, phishing sites, hackers, etc. Hardware Wallets help provide security along with being great tools when navigating through Blockchains. They are convenient because they provide security, organization, and even wallet-to-wallet trading among others.

PayPal’s Long Term Cryptocurrency Gamble and its Stock Share Consequences

PayPal updated its app to allow users to buy, sell, and hold crypto in 2020, later expanding in early 2021 with the new ability to check out millions of businesses with cryptocurrency. The business has now taken it one step further by allowing every user to transfer cryptocurrency across accounts to other wallets and exchanges.

Russia Meets Cryptocurrency — The Intersection May Have Grave Consequences

For the past ten weeks, Russia’s advance into Ukraine has exhibited more elements than pure bloodshed. Western nations have slapped sanctions on Russia, weakening its economy and condemning its war crimes. What's more, the European Union aims to phase out oil dependence on Russia. Put simply, these economic weapons are costing Russian oligarchs their yachts. Yet we can’t forget that this is the first war with cryptocurrency — one where sanctions and politics are much more complex.

El Salvador's Financial Lesson for Developing Nations

As El Salvador nears its first anniversary since crowning bitcoin, its legal currency, the country’s progress speaks volumes to Bitcoin’s viability. Before, El Salvadorian youth wanted to escape and instead pursue the American Dream. After the President declared a legal bitcoin would grant “70% of the population” access to financial services, the youth gained hope. Now the question remains: Has the financial experiment worked?

The Fall of Luna

Luna is a cryptocurrency that has boomed in popularity over the past few months. However, on Thursday, May 12th, 2022, the coin crashed to nearly 0 dollars. This collapse has left investors with billions of dollars in losses and a plethora of questions. Here is what you need to know about the fall of Luna.

The Newest Way to Take a Loan

Taking a loan is something that 22% of Americans have done. For many, loans are the only ways to afford a new house, car, or education. But taking these loans is a long and strenuous process, and they don’t always end up in the person taking the loan being satisfied. All of this leads to the question: Are technology-driven loans the best option for future loan-takers?

InsurTech: The Advancements and the Downsides

FinTech is swiftly leaving its mark on the insurance industry, as insuring and being insured has never been cheaper or faster. It’s time to give way to InsurTech - the new era of insurance.

The New Way of Purchasing: Buy Now, Pay Later

Over the past few years Buy Now, Pay Later, has become more and more popular. In fact, the Buy Now, Pay Later industry is now worth $100 Billion. Let’s have a look at what Buy Now Pay Later is, and how it is changing the way goods and services are purchased in today’s world.

How the Fintech Industry can Lift Millions out of Poverty

Poverty has been one of the world’s toughest and most important problems for a long, long time. Many solutions have been brought up to combat this challenge, but poverty is still prevalent and does not seem to be going away. Is it time we looked at Fintech for a possible solution that will help millions of people make enough to support themselves?

The Advancements of Stock Trading

In the past century, stock trading has evolved because of new methods and technologies. FinTech is advancing the process as companies like Robinhood and SoFi take the investing world by storm, making investing more straightforward and user-friendly.

Importance of Reg-Tech:

Over the past few decades, the number of regulations in the US has increased rapidly, with the number of words in the Code of Federal Regulations increasing from 35 Million to 103+ Million between 1970 and 2017. This makes it harder and harder for businesses to comply, however, a new industry called Reg-Tech is aiming to reduce the burden on companies.

Bank Branches are Closing and Moving Digital – What’s next?

In the face of a pandemic and modernization, banks are switching their business model. Financial institutions are following the trend of lowering their “branch footprint.” The benefits are multifold. For large banks, this means closing their branches and merging with smaller banks, helping fintech investment. Too often, though, has the media ignored the consequences.

The Digital Yuan: China’s Very Own Cryptocurrency

Ever since the release of the e-CNY app, the digital yuan has been rapidly growing in popularity. Issued and regulated by the government, the digital yuan is the digital version of the currency currently in circulation. Although not legally considered a cryptocurrency, as those are banned, it is essentially the same principle. Now, it's being used to pay taxes in select cities.

The Rise of Robo-Advisors

Since first coming onto the scene in 2008, Robo-Advisors have experienced tremendous growth in popularity, especially among younger generations, due to their convenience and simplicity. In 2021, Robo-Advisors managed about $460 billion collectively in the US.

Are Mobile Payments Replacing Credit Cards and Cash?

Mobile Payment Apps are growing more popular, and a future without cash is becoming accessible and easier to see. Nevertheless, we should still see the other options for transactions and decide what is best for our collective future.

Global Money Transfers: Next Gen

The same old and expensive methods are used to transfer money internationally. This may contain many fees, which reduces the amount of money that the recipient gets. However, new Fintech companies have launched a cheaper alternative and incorporated modern technology, which will change the way people transfer money for decades to come.

Bitcoin is Back After China’s Ban — But Worse

Last year when China banished cryptocurrency, experts believed that the market was doomed to crash. It didn't. The twist was that China’s crackdown wasn’t a total crackdown. Although mining was prohibited in China, the miners moved operations to other countries.

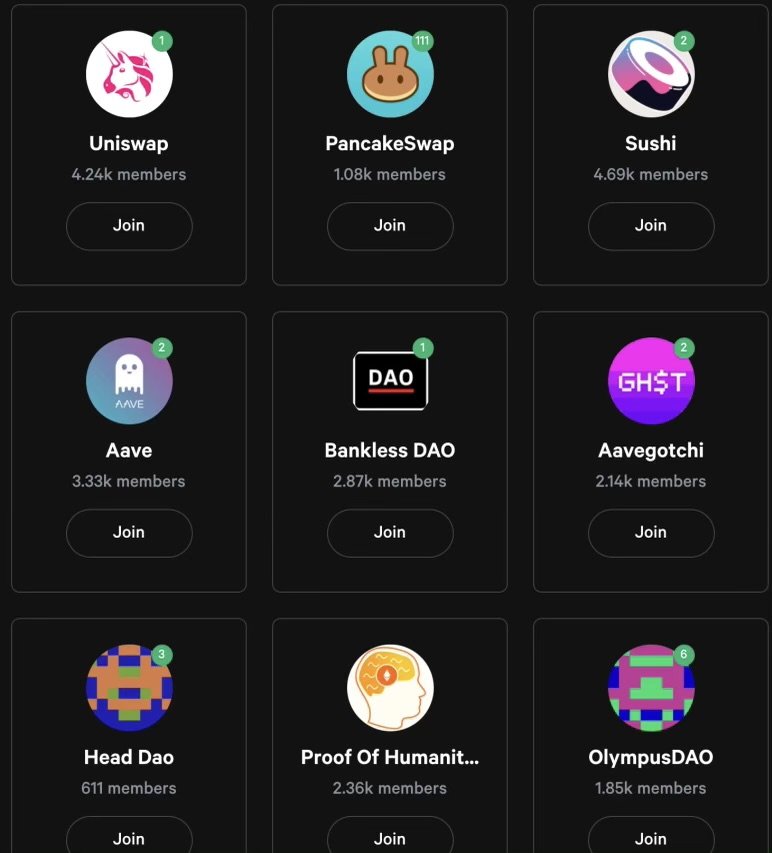

The 5 Principal Kinds of DAOs

DAOs began to garner attention in 2016 by raising $150 million in history's most extensive crowdfunding campaign. Despite being a novelty, contemporarily, they already manage over $10B+ in assets. These autonomous organizations are most predominant in 5 categories.